Bear Put Spread (BUY PUT + SELL PUT)

Establishing a bear put spread involves the purchase of a put option on a particular underlying stock, while simultaneously writing a put option on the same underlying stock with the same expiration month, but with a lower strike price. Both the buy and the sell sides of this spread are opening transactions, and are always the same number of contracts. This spread is sometimes more broadly categorized as a "vertical spread". The bear put spread, as any spread, can be executed as a "package" in one single transaction, not as separate buy and sell transactions.

Market Scenario: Moderately Bearish to Bearish

Risk: Limited

Reward: Limited

BEP: Strike Price of Purchased Put - Net Debit Paid

EXAMPLE:

Entry:

| SPOT | 5000 |

| | STRIKE | PREMIUM |

| BUY PUT | 4900 | 60 |

| SELL PUT | 4800 | 30 |

BEP = 4900 - 30 = 4870

On Exit if:

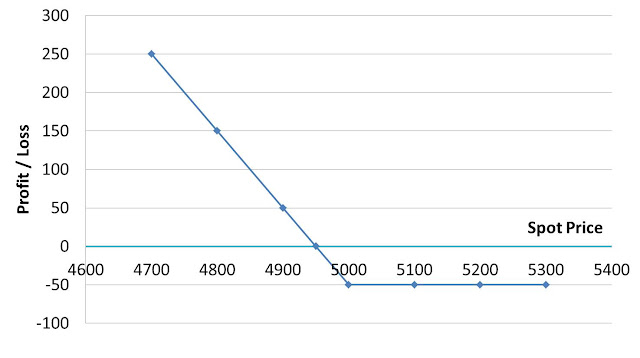

| SPOT | BUY PUT PAY-OFF | SELL PUT PAY-OFF | STRATEGY PAY-OFF |

| 4600 | 240 | -170 | 70 |

| 4700 | 140 | -70 | 70 |

| 4800 | 40 | 30 | 70 |

| 4870 | -30 | 30 | 0 |

| 4900 | -60 | 30 | -30 |

| 5000 | -60 | 30 | -30 |

| 5100 | -60 | 30 | -30 |

| 5200 | -60 | 30 | -30 |

| 5300 | -60 | 30 | -30 |

| 5400 | -60 | 30 | -30 |