BEARISH STRATEGIES

Short Call

When you buy a Call you are hoping that the underlying stock / index would rise. When you expect the underlying stock / index to fall you do the opposite. When an investor is very bearish about a stock / index and expects the prices to fall, he can sell Call options. This position offers limited profit potential and the possibility of large losses on big advances in underlying prices. Although easy to execute it is a risky strategy since the seller of the Call is exposed to unlimited risk.

Market Scenario: Bearish

Risk: Unlimited

Reward: limited

BEP: Call Strike + Premium

EXAMPLE:

Entry:

| SPOT | 5100 |

| | STRIKE | PREMIUM |

| SELL CALL | 5000 | 150 |

BEP = 5000 + 50 = 5150

On Exit if:

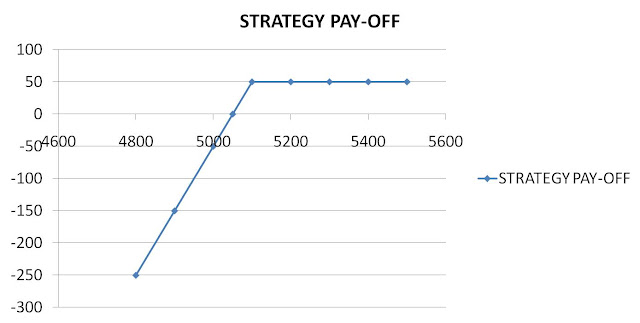

| SPOT | CALL PAY-OFF | PREMIUM RECEIVED | STRATEGY PAY-OFF |

| 4800 | 0 | 150 | 150 |

| 4900 | 0 | 150 | 150 |

| 5000 | 0 | 150 | 150 |

| 5100 | -100 | 150 | 50 |

| 5150 | -150 | 150 | 0 |

| 5200 | -200 | 150 | -50 |

| 5300 | -300 | 150 | -150 |

| 5400 | -400 | 150 | -250 |

| 5500 | -500 | 150 | -350 |