Long Put

Buying a Put is the opposite of buying a Call. When you buy a Call you are bullish about the stock / index. When an investor is bearish, he can buy a Put option. A Put Option gives the buyer of the Put a right to sell the stock (to the Put seller) at a pre-specified price and thereby limit his risk.

Market Scenario: Bearish

Risk: Limited (Premium Paid)

Reward: Unlimited

BEP: Call Strike - Premium

EXAMPLE:

Entry:

Entry:

| SPOT | 5100 |

| | STRIKE | PREMIUM |

| SELL PUT | 5000 | 50 |

BEP = 5000 - 50 = 4950

On Exit if:

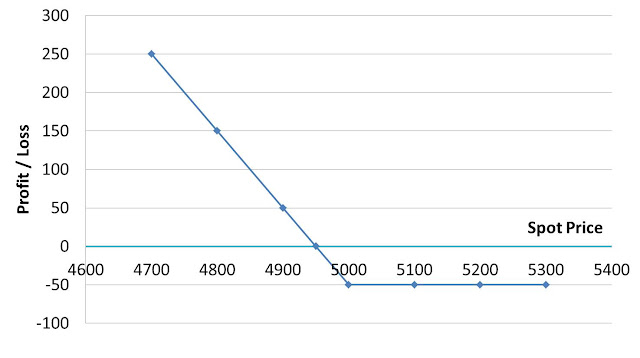

| SPOT | PUT PAY-OFF | PREMIUM PAID | STRATEGY PAY-OFF |

| 4700 | 300 | -50 | 250 |

| 4800 | 200 | -50 | 150 |

| 4900 | 100 | -50 | 50 |

| 4950 | 50 | -50 | 0 |

| 5000 | 0 | -50 | -50 |

| 5100 | 0 | -50 | -50 |

| 5200 | 0 | -50 | -50 |

| 5300 | 0 | -50 | -50 |

| 5400 | 0 | -50 | -50 |

Long Put - Strategy Pay-Off

No comments:

Post a Comment