CONDOR STRATEGIES

LONG CALL

CONDOR

BUY 1 ITM CALL

OPTION (LOWER STRIKE),

SELL 1 ITM CALL

OPTION (LOWER MIDDLE),

SELL 1 OTM CALL

OPTION (HIGHER MIDDLE),

BUY 1 OTM CALL

OPTION (HIGHER STRIKE)

A Long

Call Condor is very similar to a long butterfly strategy. The difference is

that the two middle sold options have different strikes.

Market Scenario: Low Volatility

Risk: Limited

Reward: Limited

BEP: Upper BEP = Highest Strike – Net Premium

Lower BEP = Lowest Strike + Net

Premium

EXAMPLE:

Entry:

|

SPOT

|

5000

|

|

|

STRIKE

|

PREMIUM

|

|

BUY 1 ITM CALL

|

4800

|

284

|

|

SELL 1 ITM CALL

|

4900

|

221

|

|

SELL 1 OTM CALL

|

5100

|

124

|

|

BUY 1 OTM CALL

|

5200

|

90

|

UPPER BEP: 5200 - 29 = 5171 LOWER BEP: 4800 + 29 = 4829

On Exit

if:

|

SPOT

|

BUY ITM

|

SELL ITM

|

SELL OTM

|

BUY ATM

|

STRATEGY PAY-OFF

|

|

4700

|

-284

|

221

|

124

|

-90

|

-29

|

|

4800

|

-284

|

221

|

124

|

-90

|

-29

|

|

4829

|

-255

|

221

|

124

|

-90

|

0

|

|

4900

|

-184

|

221

|

124

|

-90

|

71

|

|

5100

|

16

|

21

|

124

|

-90

|

71

|

|

5171

|

87

|

-50

|

53

|

-90

|

0

|

|

5200

|

116

|

-79

|

24

|

-90

|

-29

|

|

5300

|

216

|

-179

|

-76

|

10

|

-29

|

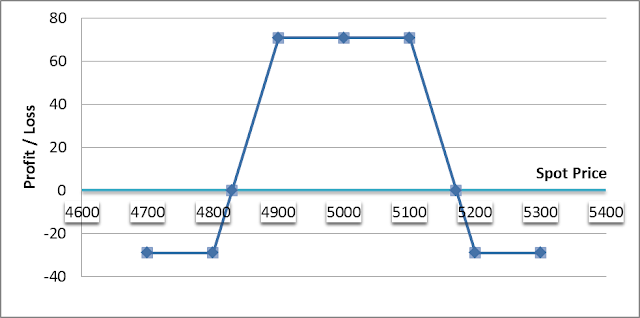

Long Call Condor - Strategy Pay-Off

No comments:

Post a Comment